BTC Price Prediction: Key Levels to Watch Amid Institutional Shifts

#BTC

- Technical Pivot: BTC tests lower Bollinger Band at $112.5K—hold could spark rebound.

- Institutional Dichotomy: Bakkt/Parataxis bets vs. whale sales create market tension.

- Volatility Lull: Historically low volatility often precedes major price movements.

BTC Price Prediction

BTC Technical Analysis: Navigating Critical Levels

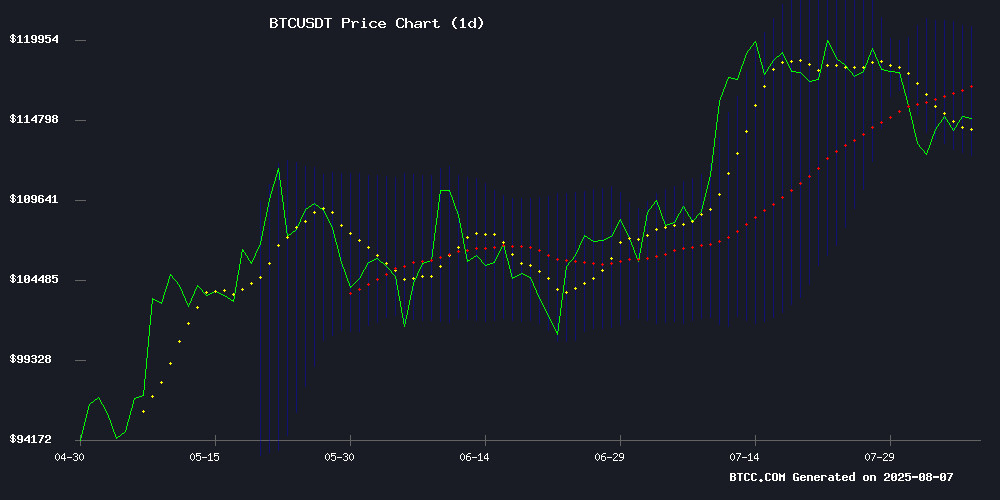

According to BTCC financial analyst Michael, BTC is currently trading at $114,763.86, slightly below its 20-day moving average (MA) of $116,654.91. The MACD indicator shows a bullish crossover with the histogram at 1,455.22, suggesting potential upward momentum. However, BTC is testing the lower Bollinger Band at $112,511.06, which could act as support. A break below this level might trigger further downside toward $105,000, while holding above it could lead to a retest of the MA and upper band at $120,798.76.

Market Sentiment: Institutional Moves and Supply Squeeze Concerns

Michael highlights mixed sentiment from recent news. Institutional adoption is growing with Bakkt's rebranding and Parataxis forming a $640M Bitcoin treasury, signaling long-term confidence. However, OTC desk shortages and whale sell-offs indicate potential supply pressure. ETF outflows and MicroStrategy's dwindling cash reserves add caution. While Trump-linked mining firm ABC's Nasdaq listing brings mainstream exposure, declining volatility suggests a period of consolidation before the next major move.

Factors Influencing BTC’s Price

Bakkt Acquires Stake in Marusho Hotta, Rebrands as “bitcoin.jp” for Crypto Treasury Shift

Bakkt Holdings is making a strategic pivot with its $115 million acquisition of a 30% stake in Japanese yarn manufacturer Marusho Hotta. The company will rebrand as "bitcoin.jp" and transition from textiles to a Bitcoin-centric treasury business. Phillip Lord of Bakkt will assume the CEO role, positioning the entity to capitalize on Japan's progressive crypto regulations.

The move signals growing institutional interest in Bitcoin treasury management, particularly in jurisdictions with clear regulatory frameworks. Japan's crypto-friendly stance provides a fertile environment for bitcoin.jp to establish itself as a corporate leader in digital asset treasury solutions.

Parataxis to Form $640M Bitcoin Treasury via SPAC Merger with SilverBox Corp IV

Parataxis Holdings is set to go public through a SPAC merger with SilverBox Corp IV, creating a NYSE-listed Bitcoin treasury entity valued at $640 million. The deal includes an immediate $31 million Bitcoin purchase and a potential $400 million equity line of credit, signaling institutional confidence in crypto asset allocation.

Market reaction was swift: SilverBox Corp's stock rose 1.32% to $10.74 in after-hours trading, reversing a 3.37% monthly decline. The merger structure targets dual-market exposure, with strategic emphasis on both U.S. and South Korean investor bases.

The newly formed entity, trading under the ticker PRTX, represents one of the largest dedicated Bitcoin treasury plays to reach public markets. Its NYSE listing provides traditional investors with regulated exposure to cryptocurrency holdings—a growing trend among corporate treasuries.

Bitcoin OTC Desk Shortage Signals Potential Supply Squeeze

Institutional Bitcoin demand is colliding with dwindling supply on over-the-counter trading desks, creating a potentially explosive market dynamic. MicroStrategy's voracious accumulation of 182,391 BTC this year has exacerbated the shortage, with Glassnode data confirming sustained exchange outflows.

The OTC market's dry-up suggests institutions are quietly positioning for the next bull cycle. While spot markets remain rangebound, this supply-demand imbalance mirrors pre-rally conditions seen in previous cycles. "When the pipes run dry, the price mechanism becomes binary," observes Bedlam Capital Pres.

Trump-Linked Bitcoin Miner American Bitcoin Corp. to List on Nasdaq

American Bitcoin Corp., a cryptocurrency mining firm with ties to Donald Trump's family, is preparing for a Nasdaq listing under the ticker ABTC. The move would mark a significant milestone, bringing a Trump-affiliated crypto venture into the mainstream financial spotlight.

The company is merging with Gryphon Digital Mining in a stock-for-stock deal, pending shareholder approval on August 27. If completed, the combined entity will begin trading in early September 2025, with Trump-linked stakeholders retaining 98% control.

Eric Trump, serving as Chief Strategy Officer, stands to hold 367 million shares—a stake initially valued at $367 million, though secondary markets suggest a more conservative $92 million valuation. The listing aligns with Donald Trump's broader pro-crypto agenda, which seeks to position the U.S. as a leader in digital assets.

The merger underscores growing institutional interest in Bitcoin mining, particularly as the industry consolidates and seeks public market validation. American Bitcoin Corp. aims to scale its hashpower to compete at the forefront of the sector.

Bitcoin Price Risk Builds as $105,000 Becomes Critical Level

Bitcoin faces a pivotal moment near the $105,000 threshold, identified as a potential danger zone by on-chain analysts. This level coincides with key realized price metrics, including UTxO clusters and short-term holder cost bases, suggesting heightened volatility ahead.

Matrixport flags $105,000 as a technical inflection point near the 21-week moving average, urging caution despite maintaining a bullish long-term outlook. Current trading at $115,166 reflects market jitters amid broader macroeconomic uncertainties, including U.S. trade policy concerns.

The $105,644 level emerges as a critical UTxO wall—a concentration of unspent transaction outputs that could trigger liquidations for overleveraged traders. 'When price meets UTxO clusters of this magnitude, it often acts as a liquidity magnet,' observes CryptoQuant's analyst.

Bitcoin Stabilizes as Profit-Taking Activity Declines Amid Market Uncertainty

Bitcoin's recent price action shows signs of stabilization as profit-taking by short-term holders slows significantly. Daily realized profits have halved from $2 billion to $1 billion over the past six months, while short-term holder profit-taking rates have dropped below the historical neutral threshold of 50% to 45%.

The cryptocurrency's rapid ascent to its $123,000 all-time high in July created a supply gap between $110,000 and $117,000, according to Glassnode data. Despite macroeconomic headwinds pushing investors toward capital preservation, opportunistic buying continues to provide support against further downside.

Market observers note that reclaiming the $116,000 level—representing the cost basis of recent buyers—could signal renewed demand-side control and potentially serve as a springboard for the next upward move.

Bitcoin's Volatility Hits Multi-Year Low Amid Stagnant Price Action

Bitcoin's price stagnation between $110,000 and $120,000 has driven its 30-day implied volatility to 36.5%, matching October 2023 levels when BTC traded below $30,000. The Volmex BVIV index reflects this decline, signaling subdued demand for options hedges despite looming stagflation concerns in U.S. economic data.

The cryptocurrency's volatility now mirrors equities, with the VIX index retreating from 21 to 17 after a brief spike. This inverse correlation between BTC's price surge (from $70,000 to $110,000 since November) and volatility marks a structural shift—historically, both metrics moved in tandem during bull and bear markets. Structured products' growing adoption is reshaping these dynamics.

Bitcoin Drops to $114K as Long-Term BTC Holders Trigger Major Sell-Off

Bitcoin fell below $114,000 amid a significant sell-off by long-term holders, including an 80,000 BTC transaction from a dormant Satoshi-era wallet. The move created downward pressure despite strong institutional interest in the market.

The cryptocurrency now trades at $114,820, showing a modest 1.06% recovery over 24 hours. Bitcoin's RSI at 48.49 indicates neutral momentum following the recent decline.

Institutional demand remains robust, with 16 companies recently announcing $7.8 billion in planned crypto investments. The market now watches whether early holder distributions will continue to outweigh institutional accumulation.

BTC Navigates Low-Liquidity Zone as Post-ATH Correction Persists

Bitcoin hovers near $115K in Asian trading, up 1% over 24 hours, as the market digests its recent all-time high. Glassnode identifies a critical "air gap" between $110K and $116K—a low-liquidity zone that could either become a consolidation platform or trigger deeper losses if demand falters.

Short-term holders' profitability has slid from 100% to 70%, a typical retracement in bull markets. Despite 120K BTC accumulated during the dip, resistance at $116.9K remains unconquered, leaving the market in a tense equilibrium between accumulation and potential downside.

MicroStrategy's Radical Bitcoin Bet Defies Market Valuation Logic as Cash Reserves Dwindle to 0.07%

MicroStrategy's stock (MSTR) tumbled despite the company revealing its boldest Bitcoin-centric balance sheet yet—holding just $50 million in fiat currency against $71 billion in treasury assets. The 0.07% cash allocation marks a record low since its BTC accumulation began, with CEO Michael Saylor doubling down on what he calls "digital property" strategy.

The market's skepticism contrasts sharply with MicroStrategy's reported $10 billion estimated net income for 2025. Analysts struggle to price a company that treats Bitcoin not as a speculative asset, but as its primary reserve currency—a first for a NASDAQ-listed firm.

While S&P 500 peers maintain conventional cash buffers, MicroStrategy's 214,400 BTC holdings now represent 99.93% of its treasury. This unprecedented corporate experiment continues to test Wall Street's valuation frameworks as traditional metrics like P/E ratios become irrelevant to Bitcoin-maximalist balance sheets.

Bitcoin Faces Pressure as Whales Sell and ETFs See Outflows

Bitcoin's early August rebound is showing signs of strain as long-dormant whales awaken and institutional interest wanes. On-chain data reveals 3,000 BTC moved by wallets inactive for 7-10 years—a classic bearish signal historically preceding price corrections. The last similar whale activity coincided with a 6% BTC drop.

Futures markets echo this caution, with taker sell volume rising to levels last seen during late July's downturn. Options markets are flashing warning signs too, as bearish sentiment builds across derivatives. While July's recovery fueled optimism, these technical indicators suggest consolidation or decline may loom.

The market faces a critical test as ETF outflows compound selling pressure. Ancient whales appear to be locking in profits at current levels, viewing the rally as overextended. This exodus of long-term holders could foreshadow deeper corrections ahead.

Is BTC a good investment?

BTC presents a high-risk, high-reward opportunity. Technicals show it's at a pivot point:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20MA | -1.6% | Mild bearish |

| MACD Histogram | +1,455 | Bullish momentum |

| Bollinger %B | 0.38 | Near oversold |

Fundamentally, institutional adoption (Bakkt, Parataxis) contrasts with whale selling. Michael advises: "DCA near $112.5K support with a stop below $105K. The $120.8K upper band is the next target."

Supply squeeze risks from OTC desk shortages

ETF outflows may continue short-term pressure

Volatility at multi-year lows could precede a breakout